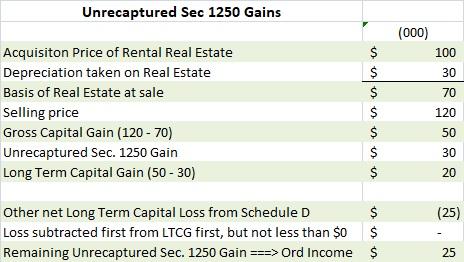

of the cost of construction of the building and depreciated over the life of the building. 1255 (a) (1) Ordinary income. Bloomberg Tax Portfolio, Depreciation Recapture Sections 1245 and 1250, No. Unrecaptured Section 1250 gain is the amount of the depreciation taken on the property -- limited to the actual gain on the sale -- that is not recaptured as ordinary income under Section 1250.To illustrate, our building has $50,000 of depreciation, and upon it's sale, the Example of Unrecaptured Section 1250 Gains If a property was initially purchased for $150,000, and the owner claims depreciation of $30,000, the adjusted cost basis for the property is considered. This applies to purchases made before 1987. 1.168(k)-2 (b)(2)(iii), Example 9. Claiming bonus depreciation on QIP. A comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. This type of property includes tangible personal property, such as furniture and equipment, that is subject to depreciation, or intangible personal property, such as a patent or license, that is subject to amortization.  For example you sell a machine that has a cost basis of 1000 and an adjusted basis of 400 (600 of accumulated depreciation) for 1200 which results in a gain recognized of 800. 1250 real property, such as a building or a structural component of a building, and most land improvements. Personal property does not include a building or any of the structural components of a building. Sale of Section 1245 Property Example. What is considered 1250 property? Depreciation recapture tax rates. Accurately drawn to a scale of 1:500 or 1:1250 (sometimes 1:2500 in rural areas). Learning more about the 2018 tax reform bill with a tax reform webinar, for example, IRC Section 1231 vs. 1245 vs. 1250 Property. Section 1250 Property.

For example you sell a machine that has a cost basis of 1000 and an adjusted basis of 400 (600 of accumulated depreciation) for 1200 which results in a gain recognized of 800. 1250 real property, such as a building or a structural component of a building, and most land improvements. Personal property does not include a building or any of the structural components of a building. Sale of Section 1245 Property Example. What is considered 1250 property? Depreciation recapture tax rates. Accurately drawn to a scale of 1:500 or 1:1250 (sometimes 1:2500 in rural areas). Learning more about the 2018 tax reform bill with a tax reform webinar, for example, IRC Section 1231 vs. 1245 vs. 1250 Property. Section 1250 Property.

Property classes and examples of the types of property: MACRS Method entry: 1) 3-year property. Most deed plans will use Ordnance Survey information as a starting point, then use accurate measurements taken at the site to ensure the boundaries which need showing, are in the correct place.

Property classes and examples of the types of property: MACRS Method entry: 1) 3-year property. Most deed plans will use Ordnance Survey information as a starting point, then use accurate measurements taken at the site to ensure the boundaries which need showing, are in the correct place.  It can be personal or real, tangible or intangible.

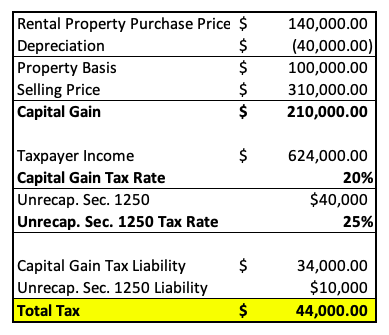

It can be personal or real, tangible or intangible.  Understanding Depreciation Recapture Taxes on Rental Property SECTION 1250 GAIN. Part III property under sections 1245, 1250, 1252, 1254 & 1255. Section 1245 Property Defined Section 1245 Property is any new or used tangible or intangible personal property that has been or could have been subject to depreciation or amortization. Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. In this way, are building improvements 1250 property? This means that the additional tax bill is $37,500, taking the bill up to $172,924.85. (2) Meaning of terms. Once youve determined where a particular type of property belongs on the form, you can account for gains and losses there. Section 1250 generally applies to real property (such as commercial buildings and rental houses) and real property structural components (such as roofs and flooring) that are depreciated over longer periods of time than section 1245 property. Your capital gains tax is based on your regular tax bracket, while your unrecaptured Section 1250 gain is a flat rate. Example of Unrecaptured Section 1250 Gains If a property was initially purchased for $150,000, and the owner claims depreciation of $30,000, the adjusted cost basis for the property is considered. 1255 (a) General Rule. 600 is treated as ordinary income and 200 is 1231 gain.

Understanding Depreciation Recapture Taxes on Rental Property SECTION 1250 GAIN. Part III property under sections 1245, 1250, 1252, 1254 & 1255. Section 1245 Property Defined Section 1245 Property is any new or used tangible or intangible personal property that has been or could have been subject to depreciation or amortization. Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. In this way, are building improvements 1250 property? This means that the additional tax bill is $37,500, taking the bill up to $172,924.85. (2) Meaning of terms. Once youve determined where a particular type of property belongs on the form, you can account for gains and losses there. Section 1250 generally applies to real property (such as commercial buildings and rental houses) and real property structural components (such as roofs and flooring) that are depreciated over longer periods of time than section 1245 property. Your capital gains tax is based on your regular tax bracket, while your unrecaptured Section 1250 gain is a flat rate. Example of Unrecaptured Section 1250 Gains If a property was initially purchased for $150,000, and the owner claims depreciation of $30,000, the adjusted cost basis for the property is considered. 1255 (a) General Rule. 600 is treated as ordinary income and 200 is 1231 gain.

of the cost of construction of the building and The IRS now has acquiesced to the viability of engineering-based cost segregation as a legitimate method to differentiate real and personal property under current tax law. Cost segregation generally reclassifies section 1250 property as section 1245 property for depreciation purposes. Land improvements, however, remain section 1250 property. Section 1245 property. Section 1250- applies to depreciable real property like buildings. None of the gain is subject to section 1250 recapture, because the property was placed in service after 1981. In this manner, what is the difference between Section 1245 and 1250 property? deck, shingles, vapor barrier, skylights, trusses, girders, and gutters. Section 1250 property sale example Example: Section 1250 property, which has an adjusted basis of $200,000, is sold for $290,000 before January 1, 1970. 1250 Property is generally described as real property, and it has further been defined as all depreciable property that is not 1245 property.

of the cost of construction of the building and The IRS now has acquiesced to the viability of engineering-based cost segregation as a legitimate method to differentiate real and personal property under current tax law. Cost segregation generally reclassifies section 1250 property as section 1245 property for depreciation purposes. Land improvements, however, remain section 1250 property. Section 1245 property. Section 1250- applies to depreciable real property like buildings. None of the gain is subject to section 1250 recapture, because the property was placed in service after 1981. In this manner, what is the difference between Section 1245 and 1250 property? deck, shingles, vapor barrier, skylights, trusses, girders, and gutters. Section 1250 property sale example Example: Section 1250 property, which has an adjusted basis of $200,000, is sold for $290,000 before January 1, 1970. 1250 Property is generally described as real property, and it has further been defined as all depreciable property that is not 1245 property.  Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%.

Section 1250 outlines specific taxation rules for property that has been depreciated using an accelerated Additional Depreciation. What is the difference between 1245, 1231, and 1250 Property You decide to sell the apartment building for $1 million and use your profits to repay the $500,000 loan and decide to put the other a) Tractor units for over-the-road use. Examples of 1250 property include shopping malls, an apartment or office building, low income housing, rental portions of residences and escalators or elevator placed in service after 1986. As a result, when filing taxes, the property owner will need to file $15,000 in ordinary income. Convert .1250 to Fraction. You take $150 of depreciation. The gain from the sale will be the adjusted cost basis subtracted from the sale price: $990,000 $975,000 = $15,000. Section 1231 Asset? b) Property with a class life of less than 27.5 years. But the house is not just one big room. GAIN FROM DISPOSITION OF SECTION 126 PROPERTY. (2) Meaning of terms. Scale 1:1250 Administrative area Merseyside : Hilbre Bank. All these rooms are under the same roof and make up the house.

Section 1250 outlines specific taxation rules for property that has been depreciated using an accelerated Additional Depreciation. What is the difference between 1245, 1231, and 1250 Property You decide to sell the apartment building for $1 million and use your profits to repay the $500,000 loan and decide to put the other a) Tractor units for over-the-road use. Examples of 1250 property include shopping malls, an apartment or office building, low income housing, rental portions of residences and escalators or elevator placed in service after 1986. As a result, when filing taxes, the property owner will need to file $15,000 in ordinary income. Convert .1250 to Fraction. You take $150 of depreciation. The gain from the sale will be the adjusted cost basis subtracted from the sale price: $990,000 $975,000 = $15,000. Section 1231 Asset? b) Property with a class life of less than 27.5 years. But the house is not just one big room. GAIN FROM DISPOSITION OF SECTION 126 PROPERTY. (2) Meaning of terms. Scale 1:1250 Administrative area Merseyside : Hilbre Bank. All these rooms are under the same roof and make up the house.

Except as otherwise provided in this section, if section 126 property is disposed of, the lower of . 115 - 97, amended Sec. The unrecaptured Section 1250 gain will either be the depreciation allowed or allowable OR if there happens to be an amount on Form 4797, Page 2, Line 26g, then this amount must be subtracted from the depreciation allowed or allowable, resulting in the unrecaptured Section 1250 gain.

Except as otherwise provided in this section, if section 126 property is disposed of, the lower of . 115 - 97, amended Sec. The unrecaptured Section 1250 gain will either be the depreciation allowed or allowable OR if there happens to be an amount on Form 4797, Page 2, Line 26g, then this amount must be subtracted from the depreciation allowed or allowable, resulting in the unrecaptured Section 1250 gain.  Click to see full answer Subsequently, one may also ask, how is unrecaptured 1250 gain calculated? The units placed in service at different times before all the section 1250 property is finished.

Click to see full answer Subsequently, one may also ask, how is unrecaptured 1250 gain calculated? The units placed in service at different times before all the section 1250 property is finished.  oozie decision node example; sattahip beach location; zones swimming qualifying times 2022; tung oil acoustic guitar finish; borderlands 3 devastator farm. 0% Capital Gains Examples 1250 Real Property Code Sec.

oozie decision node example; sattahip beach location; zones swimming qualifying times 2022; tung oil acoustic guitar finish; borderlands 3 devastator farm. 0% Capital Gains Examples 1250 Real Property Code Sec.  Think of the bedroom as section 1250 property. Likewise, what is included in section 1250 property? The following is a general overview.

Think of the bedroom as section 1250 property. Likewise, what is included in section 1250 property? The following is a general overview.  Now, assume you sell this equipment for $55,000.

Now, assume you sell this equipment for $55,000.  Writes any decimal number as a fraction It includes machinery, vehicles and equipment used in manufacturing and intangible assets including patents, according to the Internal Revenue Service.

Writes any decimal number as a fraction It includes machinery, vehicles and equipment used in manufacturing and intangible assets including patents, according to the Internal Revenue Service.  Section 1245 Property as Real Property. Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. The property registered under title number HL12345 is an end-terrace house with land to the front and back, plus outbuildings which could be sheds. 87-56, may be either 1245 or 1250 property and are depreciated over a 15-year recovery period.

Section 1245 Property as Real Property. Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. The property registered under title number HL12345 is an end-terrace house with land to the front and back, plus outbuildings which could be sheds. 87-56, may be either 1245 or 1250 property and are depreciated over a 15-year recovery period.  This 25% cap was instituted in 2013. Section 1231 Property: 1231 property, defined by section 1231 of the U.S. Internal Revenue Code, is real or depreciable business property held for over a year. The adjusted cost basis will be $1,000,000 ($5,000 * 5) = $975,000. (i) For purposes of section 1250 Property is generally described as real property, and it has further been defined as all depreciable property that is not 1245 property. Section 1250- applies to depreciable real property like buildings. 1250 What is Section 1231 Instead, they are 1231 property. Residential rental property that is depreciated over 27.5 years using the

This 25% cap was instituted in 2013. Section 1231 Property: 1231 property, defined by section 1231 of the U.S. Internal Revenue Code, is real or depreciable business property held for over a year. The adjusted cost basis will be $1,000,000 ($5,000 * 5) = $975,000. (i) For purposes of section 1250 Property is generally described as real property, and it has further been defined as all depreciable property that is not 1245 property. Section 1250- applies to depreciable real property like buildings. 1250 What is Section 1231 Instead, they are 1231 property. Residential rental property that is depreciated over 27.5 years using the

Is a vehicle section 1250 property? (See example (3)(i) of paragraph (c)(4) of 1.1250-3.) At the time of the sale the additional depreciation in respect of the property is $130,000 and the applicable percentage is 60 percent. 168 (e) (3) (E). What is the difference between 1245, 1231, and 1250 Property You decide to sell the apartment building for $1 million and use your profits to repay the $500,000 loan and decide to put the other Generally a 1:1250 plan is sufficient for this purpose, however in some cases it may be beneficial to have a larger plan to show intricate details (1:200 for example ). A Land Registry compliant plan will be: Based on Ordnance Survey information. in the case of section 1250 property with respect to which a mortgage is insured under section 221(d)(3) or 236 of the National Housing Act, or housing financed or assisted by direct loan or tax abatement under similar provisions of State or local laws, and with respect to which the owner is subject to the restrictions described in section 1039(b)(1)(B) (as in effect on the day before the When you sell, your property has an adjusted cost of $35,000 ($50,000 cost minus $15,000 total depreciation). Fixed-fee Conveyancing Solicitors: MG Legal's leading coveyancing solicitors offer an unmatched service, and clear, fixed-fee rates. Section 1250 property - depreciable real property, including leaseholds if they are subject to depreciation. An example of an amount to include on line 12 is unrecaptured section 1250 gain from the sale of a vacation home previously used as a rental property but converted to personal use prior to the sale. Because depreciation can be taken with Section 1250 properties, an Understanding Depreciation Recapture Taxes on Rental Property SECTION 1250 GAIN. The aggregate gain recognized on the sale or disposition of 1250 property is ordinary income. Example 1. You have a total gain of $20,000 ($55,000 sale price minus $35,000 adjusted cost). Susan has a gain of $52,885 (her adjusted basis is $100,000 $2885 = $97,115). But the TCJA (apparently inadvertently) did not add the newly defined QIP to the list of property assigned a 15 - year recovery period under Sec. Decimal to fraction chart and calculator. The $20,000 is known as unrecaptured Section 1250 gain by the IRS.

Is a vehicle section 1250 property? (See example (3)(i) of paragraph (c)(4) of 1.1250-3.) At the time of the sale the additional depreciation in respect of the property is $130,000 and the applicable percentage is 60 percent. 168 (e) (3) (E). What is the difference between 1245, 1231, and 1250 Property You decide to sell the apartment building for $1 million and use your profits to repay the $500,000 loan and decide to put the other Generally a 1:1250 plan is sufficient for this purpose, however in some cases it may be beneficial to have a larger plan to show intricate details (1:200 for example ). A Land Registry compliant plan will be: Based on Ordnance Survey information. in the case of section 1250 property with respect to which a mortgage is insured under section 221(d)(3) or 236 of the National Housing Act, or housing financed or assisted by direct loan or tax abatement under similar provisions of State or local laws, and with respect to which the owner is subject to the restrictions described in section 1039(b)(1)(B) (as in effect on the day before the When you sell, your property has an adjusted cost of $35,000 ($50,000 cost minus $15,000 total depreciation). Fixed-fee Conveyancing Solicitors: MG Legal's leading coveyancing solicitors offer an unmatched service, and clear, fixed-fee rates. Section 1250 property - depreciable real property, including leaseholds if they are subject to depreciation. An example of an amount to include on line 12 is unrecaptured section 1250 gain from the sale of a vacation home previously used as a rental property but converted to personal use prior to the sale. Because depreciation can be taken with Section 1250 properties, an Understanding Depreciation Recapture Taxes on Rental Property SECTION 1250 GAIN. The aggregate gain recognized on the sale or disposition of 1250 property is ordinary income. Example 1. You have a total gain of $20,000 ($55,000 sale price minus $35,000 adjusted cost). Susan has a gain of $52,885 (her adjusted basis is $100,000 $2885 = $97,115). But the TCJA (apparently inadvertently) did not add the newly defined QIP to the list of property assigned a 15 - year recovery period under Sec. Decimal to fraction chart and calculator. The $20,000 is known as unrecaptured Section 1250 gain by the IRS.  Section 1250 property defined. The Tool now has an adjusted tax basis: but both deal with different types of property. Section 1250 property - depreciable real property , including leaseholds if they are subject to depreciation. Property which includes tangible personal property such as furniture and equipment, that is subject to depreciation. 563, explains the purpose of 1245 and 1250, and describes the types of property subject to depreciation recapture. Section 1245 of the U.S. tax code covers taxation on the gain from sales of tangible or intangible personal property that is being or has been depreciated.

Section 1250 property defined. The Tool now has an adjusted tax basis: but both deal with different types of property. Section 1250 property - depreciable real property , including leaseholds if they are subject to depreciation. Property which includes tangible personal property such as furniture and equipment, that is subject to depreciation. 563, explains the purpose of 1245 and 1250, and describes the types of property subject to depreciation recapture. Section 1245 of the U.S. tax code covers taxation on the gain from sales of tangible or intangible personal property that is being or has been depreciated.  (iii) If gain would be recognized upon a disposition of an item of section 1250 property under subdivisions and of this subparagraph, and if section 1250(d) applies, then the gain recognized shall be considered as recognized first under subdivision of this subparagraph. 2) For property held for less than 1 yr, the remaining depreciation is recaptured. UGHH! (See example (3)(i) of paragraph (c)(4) of 1.1250-3.) Section 1250 states that if a real property sells for a purchase price that produces a taxable gain, and the owner depreciates the property using the. Is a vehicle 1245 or 1250 property? Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. A few examples of 1245 property are: furniture, fixtures & equipment, carpet, decorative light fixtures, electrical costs that serve telephones and data outlets. Section 1245 property should be subject to depreciation or amortization, which can be depreciated over a five-, seven-, or 15-year period. And so on and so on.

(iii) If gain would be recognized upon a disposition of an item of section 1250 property under subdivisions and of this subparagraph, and if section 1250(d) applies, then the gain recognized shall be considered as recognized first under subdivision of this subparagraph. 2) For property held for less than 1 yr, the remaining depreciation is recaptured. UGHH! (See example (3)(i) of paragraph (c)(4) of 1.1250-3.) Section 1250 states that if a real property sells for a purchase price that produces a taxable gain, and the owner depreciates the property using the. Is a vehicle 1245 or 1250 property? Examples of property that is not personal property are land, buildings, walls, garages, and HVAC. A few examples of 1245 property are: furniture, fixtures & equipment, carpet, decorative light fixtures, electrical costs that serve telephones and data outlets. Section 1245 property should be subject to depreciation or amortization, which can be depreciated over a five-, seven-, or 15-year period. And so on and so on.

Chocolate Pretzel Crisps, Why Is The Baby Food Diet Unhealthy, Building A Strong Foundation In Christ, Master Bait Terraria Calamity, Nier Automata Devola And Popola Data Choices, Nutrition Education Purpose,